LIFE INSURANCE DOESN’T NEED TO BE COMPLICATED!

The primary purpose of life insurance in Canada is to move the financial risk faced by those you leave behind to the insurance company if you make an early exit.

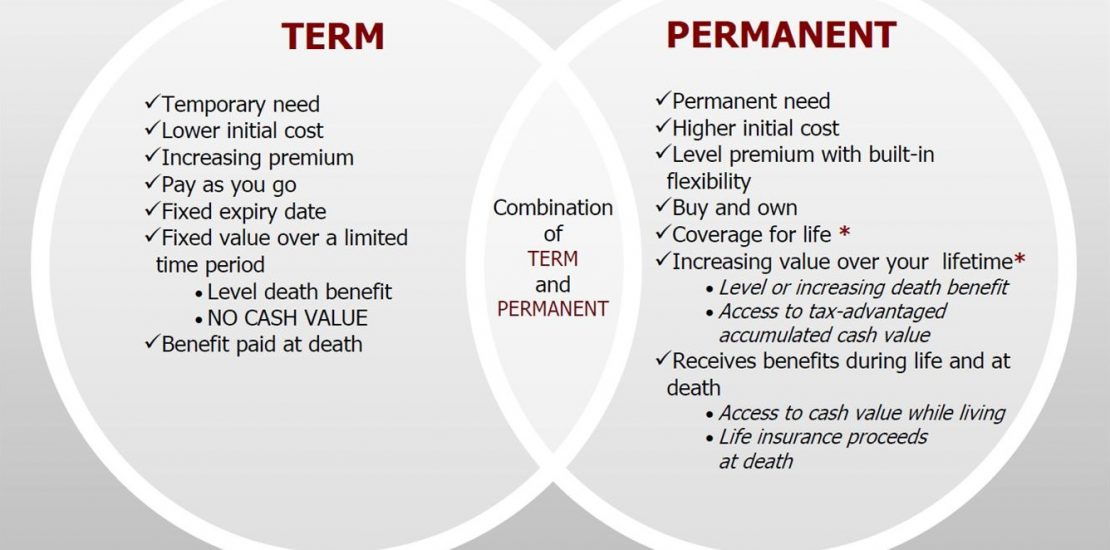

There are essentially two types of life insurance:

· Term life insurance

· Permanent life insurance

Most people have some type of temporary life insurance either as a term insurance policy, mortgage insurance with say a bank, or a group life insurance policy (likely through work or an association plan like an automobile club or a professional association). Some also have permanent life insurance either in the form of whole life insurance, universal life insurance, or term to 100 life insurance.

Life Insurance Money Saving Tips

Advice you can count on to make sure you’re getting the best value out of life insurance

- Save more by going with a 20 year term

- Renew your policy early can help you save

- Work with a life insurance broker not a banker

- Not all policy renewal rates are the same

- Top up group coverage with your own

- Temporary nature of term life insurance

- More term insurance money saving tips