What is permanent life insurance?

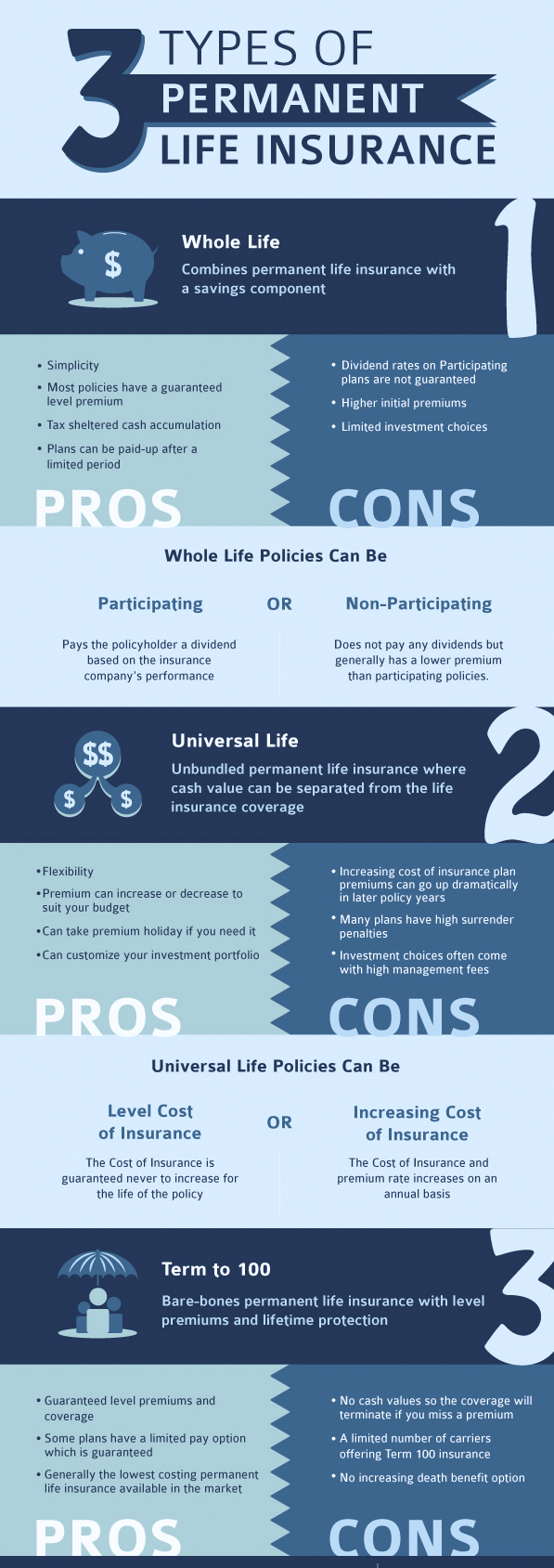

Permanent life insurance is often called whole life insurance because it covers you for your whole life. It provides your beneficiaries a tax-free payment after you die. Some plans can build cash value over time. Permanent insurance costs are usually guaranteed not to increase from the time you first buy the policy. And some permanent insurance plans let you pay for a limited time and then never again. Universal life and participating life are other forms of permanent life insurance that you may want to consider.

Benefits of Permanent Life Insurance

Lifetime Coverage

With permanent life insurance, you are covered for life—your coverage does not end after a certain term.

Guaranteed Premiums

Premiums are guaranteed when you buy your coverage and remain unchanged for the life of your policy.

Tax-Free Benefit

Permanent life insurance provides a tax-free death benefit to your beneficiaries when you pass away.

Talk to Our Financial Advisors to help you choose which option is best for you!! Contact Us Today!