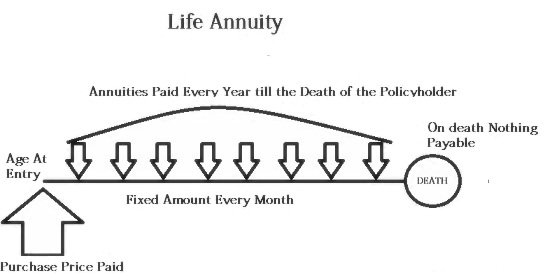

Life Annuity

Life Annuity is an insurance contract that guarantees you’ll receive income payments for life no matter how long you live.

When you die however, any money left in the annuity goes to the issuer, not your estate. The exception would be if you arrange an annuity which has a guaranteed payment period.

Once you’ve purchased your annuity, you never have to worry about how that money is invested or how long your income will last.

TYPES OF ANNUITIES

| Type | Detail |

| Straight Life Annuity |

|

| Life Annuity with a Guaranteed Period | This provides a guarantee that you or your beneficiary will receive back all of your investments plus full interest if you wish, even if you only live for a short time. The longer the guaranteed period, the lower the payments |

| Joint and Last Survivor Annuity | This annuity provides a regular income as long as either spouse is living. Payments can continue at the full amount to the surviving spouse, or they can be reduced by any stipulated percentage on the death of either spouse or specifically at your death. Selecting the reduction option will result in higher payments while both spouses are alive. |

| Installment Refund Annuity | If you die before you have received as much money as you paid for the annuity, this annuity will continue income payments to your beneficiary until they equal the amount you originally paid. |

| Cash Refund Annuity | In this annuity, rather than your beneficiary receiving continued income payments, as in the above example, they receive a lump-sum payout instead. |

| Indexed Life Annuity | This provides for annuity payments that either increase each year automatically, from one to five percent. Although this provides you with some protection against rising living costs due to inflation, it will also reduce your payments in the early years. |

| Integrated Life Annuity | If you wish, you can integrate your Old Age Security (OAS) payments with your annuity. With this annuity, you would receive substantially increased annuity payments until age 65, at which time the payments will reduce by the maximum OAS entitlement at the time you purchased the annuity. |